|

|

Nevada Registered Agent Service™ The

PREFERRED choice in Registered Agents since 1991 |

||

|

||||

What are the Benefits of an LLC Over an S Corporation

in Nevada?

Last updated Monday, June 16, 2025

With the passing of the check-the-box-Regulations at the end of

1996, LLCs now can enjoy limited liability, centralized management, free

transferability of interests, and continuity of life, and still be taxed as

a partnership Federally!

Around the same time as the check-the-box regulations were being

put in place S corporations’ rules were being revised. There were 17 statutory

amendments enacted by Congress as part of the Small Business Job Protection Act

of 1996. The Sub S amendments were intended to promote similarities between the

S corporation and partnerships. For example, now S corporations can have up to

75 shareholders and an S corporation can own any percentage of stock in a C

corporation (remember a C corporation, LLC or LP can not

be the stockholder of the S corporation). That is why it is so hard to protect

the S corporation stock).

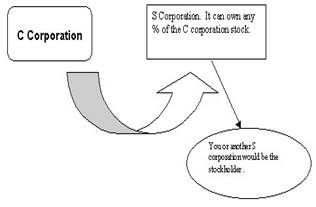

Example 1: It is ok for an S corporation to own Stock in a

Corporation.

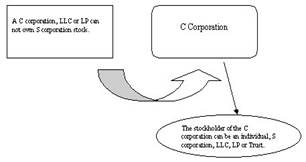

Example 2: It is NOT ok for an S corporation stockholder to

be a C corporation Sec.

1361 (b)(1)(B).

*A Term LLC will dissolve at a predetermined date, i.e. 30 years

from the date of formation. An at-will LLC will dissolve under basic

partnership rules.

Because of these changes, we need to reanalysis the S corporation

compared to a C corporation.

Let’s examine the following areas of differences between S

corporations and LLCs:

1. State

Law Differences

2. Eligibility

Limitations

3. Multi-Tiered

Structures

4. Tax

Rates

5. Certainty

of Tax Status

6. Tax-Free

Formation Issues

7. Equity

Interests Received For Services

8. Entity-Level

Taxation

9. Use

of Cash Methods

10.Debt-Basis

Issues

11.Distributions

12.Sales

or Exchanges of Equity Interests

State Law Differences

A corporation C or S is organized under a governing state

statue pursuant to its corporate charter. All corporations start out as C

corporation then have to make an election within 75 days to become an S

corporation, form 2553. The corporate charter generally requires the disclosure

of the following:

1. The

corporation’s purpose

2. Incorporators

of the corporation

3. Place

of the Resident Agent

4. Initial

Board of Directors

5. Classes

of Stock

Following the filling of the articles of incorporation, the Bylaws

are adopted. Minutes and meetings are held and stock is then issued. Buy-sell

agreements may then be put in place to handle the death of one of stockholder.

A corporation has limited liability to its owners, has centralized management

though the board of directors, and exists perpetually until it either becomes

bankrupt or is liquidated and dissolved by the vote of a majority of its

shareholders.

An LLC is also a creature of the state. It has the best of both

worlds of a corporation and a limited partnership. In the past you had to be

careful not to have two or more of the corporate characteristics so you would

be taxed as a partnership. Now, with the check-the-box rules you do not have to

worry about that. So the LLC allows much more

flexibility in its drafting. Much of this flexibility comes from the operating

agreement.

Despite this difference with an S corporation and LLC, the states

basically provide the same limited liability for shareholders of an S

corporation as with members of an LLC.

Conclusion: State law should be considered a neutral

factor in comparing multiple-member LLCs to S corporations. The single

member LLC is recognized in 21 jurisdictions and may afford less

protection from unlimited liability to its owners. In contrast, the

single-shareholder S corporation still insures limited

liability (this assumes the corporate veil will not be pierced. That is another

advantage of Nevada because it is the most difficult state in the country in

which to pierce the corporate veil).

Eligibility Limitations

There is no limitation on the number of investors who can

participate in an LLC taxed as a partnership. The exception is a publicly

traded partnership provisions under Section 7704, which recast a pass-through

entity under state law into an "association" for federal income tax

purposes.

Even though 21 states allow single member LLCs, most states do

not. A challenge comes about when you form an LLC in a state that allows one

person LLCs and then you have to register to do business in a state that does

not recognize one person LLCs. This is all despite the fact that the –box rules

allow a single person LLC.

Subchapter S corporations have always capped the number of

stockholders to its present-day number of 75. Spouses (and their estates) are

considered to be one shareholder Sec. 1361 (C)(1).

The next area to compare is who can be eligible to be equity

participants. Since any individual or entity, foreign or domestic, can be a

member of an LLC, the LLC has substantial advantages over the S corporation.

The S corporations are subject to rigid rules as who can be owners. As we

already mentioned, LLCs, corporations, LPs, and certain trusts can not be owners of S corporations. Only a grantor trust,

qualified Subchapter S trust (QSST), or the new electing small business trust

(ESBT).

Now, let’s compare the limitations on use of debt/equity. Since

S corporations only have one class of stock, LLCs have an advantage. An S

corporation can not provide a liquidation or

distribution preference to a shareholder. Even a buy-sell agreement must be

carefully drafted as not to provide a second class of stock Reg. 1.1361-1(l).

In other words, you cannot draft a buy-sell agreement to circumvent the single-class-of-stock

requirement and the agreement establishes a redemption or purchase price which,

at the time the agreement was entered into, was significantly below or in

excess of the stock’s FMV Reg.1.1361-1(l)(2)(iii). This regulation basically

says agreements to redeem or purchase stock upon the death, divorce, disability

termination of employment is disregarded under the single-class-of-stock

analysis. An S corporation can issue or enter into the following types of

securities or arrangements without placing its pass-through status at risk:

1. Qualified

straight debt-Sec 1361 (c)(5). This basically means a debt that is

written and unconditional obligation to pay a sum certain in money with

interest rate and payments dates not conditioned on the borrower’s profits or

discretion and which is not convertible directly or indirectly into stock. The

holder must be an eligible shareholder; there are exceptions after 1996 on

this.

2. Nonvoting

common stock- Sec 1361(c)(4).

3. Equity-type

arrangements not resulting in the issuance of stock, including

options (other than "in-the-money"), phantom stock or stock

appreciation rights-Reg. 1.1361-1(b)(4).

4. A

joint venture or other business arrangement with persons otherwise unable to

own stock in the S corporation directly- Reg. 1.1361-1(l)(4)(ii)(A)(2).

By contrast LLCs and partnerships can issue multiple classes of

equity interests, create distribution and liquidation preferences, provide for

special allocation of tax items (within the boundaries of Section 704), and

issue equity-flavored debt.

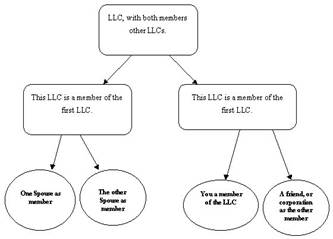

Multiple-Tiered Structures

An LLC or LP can be itself a member or partner of other LLCs or

LPs. Multiple tiered structures allow for protection against creditors and

separation of business assets. A typical situation may look like this:

Until the 1996 Act, S corporations were greatly disadvantaged in

this area. For example an S corporation could not own

80% of the value of stock of another corporation. Now, the 1996 Act permits

an S corporation to own any percentage of stock in a C corporation.

These S corporations’ structures have limitations unlike C corporation’s

structures.

For example, dividends paid to the parent S corporation are

ineligible for a dividends-received deduction and other transactions are

excluded from the application of consolidated return rules.

Tax Rates

From a federal income tax standpoint, an LLC member who is an

individual and the shareholders of S corporations are equally subject to the

maximum marginal rate of 39.6%. By contrast, the maximum rate of federal income

tax on a C corporation is 35%. Can you see how with an LLC there may be a tax

advantage to have a C corporation as the member?

There is however, a slight advantage for shareholders in S

corporations in the employment tax area. The combination of FICA, FUTA and

Medicare taxes for employee shareholders of an S corporation is 15.3% of the

first $76,200 of wages-Rev.Rul. 59-221, 1959-1CB 225.

By setting a reasonable salary, a shareholder of an S corporation can avoid

paying the additional Medicare taxes of 2.9% on the distributive share of

income from the S corporation. According to Sandy Botkin, he recommends

taking a salary of about 50% of the S corporation’s net profits. So, if the S

corporation has net earnings of $100,000 at years end, $50,000 should be salary

subject to payroll taxes.

For partnerships it is different. Under Section 1402 (a), an

individual partner’s net earnings form self employment,

also taxed at a rate of 15.3%, includes the individual’s distributive

share of partnership income (exceptions are for rental income, section

1402 (a)(1), interest and dividends Section 1402 (a)(2), and capital gains and

losses 1402 (a)(3). What does this mean? If you have rental property or

investments in an LLC that income will not flow though to you subject to

self-employment taxes! Keep in mind a limited partner’s receipt of a guaranteed

payment for services is within the self-employment tax base.

The main question for an LLC is whether the member is a limited

partner or not! Prop. Reg. 1.1402(a)-2 provides an investor in a

pass-through entity, including an LLC, will be a limited partner for

self-employment tax purposes unless such individual:

1. Is

personally liable for entity debts by reason of being a partner or member,

2. Has

authority to contract on behalf of the entity under state law or the governing

instrument, or

3. Participates

for more than 500 hours during the tax year in the entity’s trade or business.

So if you have the authority

to bind the LLC, liable for the debt and work more than 500 hours per year you

will be subject to SE taxes. SEE pages for more detail on SE taxes.

Certainty of Tax Status

Despite the reforms with the S corporations’ shareholders, great

efforts must be followed to not lose the S status. Once lost, an S corporation can not re-elect S status for five years. In contrast with

the check-the-box rules, the tax status of an LLC as a pass-through entity is

simple to establish and maintain. The advantage clearly goes to the LLC in this

category.

Tax-Free Formation Issues

Assets can be transferred to a corporation tax-free under Section

351 provided the transferors control the corporation. Section 368 (c) defines

control for purposes of ownership to be at least 80%. So, if you transfer an

asset to an S corporation and you want it to be tax-free you must take back 80%

of the stock. If you are transferring an asset that has a greater debt than

basis (mortgage over basis), the excess above the basis will result in a

taxable gain.

Example: You have a rental property with a FMV of $150,000. It has

a basis of $50,000 and a mortgage of $75,000. Under Sec. 351 you could transfer

it to the S corporation. Since there is a mortgage over basis of $25,000, you

would pay personal income tax on that $25,000.

In an LLC, when you transfer assets tax-free into that falls under

Section 721. These are the partnership rules for tax-free transfers.

They are very similar to the corporation.

Equity Interests Received for

Services

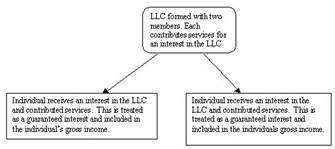

When a member of an LLC receives a membership interest in exchange

for services, the transfer falls outside of Section 721. The value of the

capital interest is treated as a guaranteed interest and is included in gross

income. Section 707 (c) and Reg. 1.721-1(b)(2).

This immediate taxation can be avoided if the members contribute

property or capital to the LLC. It may be each member contributing as little as

$500 for his or her interest in the LLC.

In an S (and C) corporation, the receipt of stock for services is

taxable to the recipient provided the stock is nonforfeitable or transferable

–Sections 83 (a) and 1032 (nonrecognition for exchange of a corporation’s own

stock). A corresponding deduction is allowed to the corporation- Section 83 (h)

and Reg. 1.83-6.

Entity-Level Taxation

The LLC is not subject to federal income tax unless it

affirmatively elects to be taxed as an association. Also, single member LLCs

are also ignored for federal income tax purposes unless the owner opts to be

taxed as a corporation. Some states have a franchise tax on LLC income, most

states do not. The LLCs tax year generally must conform to that of the majority

in interest of its members- Section 706 (b).

The tax year of an LLC will close on a termination or sale of 50%

or more of the equity interests within a year. It will also close with respect

to a withdrawing member who sells, exchanges, or liquidates his entire

interest.

The tax year of an S corporation may be closed in the event of the

complete termination of a shareholder’s interest or where a certain percentage

of its stock is sold over a certain period – Section 1377(a)(2); see also Reg.

1.1377-1(b). S corporations are generally not subject to corporate income

taxes. The exceptions to non-entity level taxation are applicable to former C

corporations that convert to S status. For example, under Section 1374 on net

built-in-gains recognized during a ten-year post-C-to-S conversion period,

there is a corporate tax imposed.

Another example would be a C corporation converting to S status is

required to recapture the LIFO-FIFO spread over a four-year period-Section 1363

d. The S corporation’s tax year generally must be a calendar year or one that

is the same as its principal shareholders- Section 1378.

Use of Cash Method

Typically, an LLC is not permitted to use the cash method of

accounting- Sections 446 (c) and 448 (a). This is based upon the definition of

"tax shelter" in Section461 (I) (3). The IRS however, issued several

rulings permitting an LLC to use the cash method where;

1. The

LLC did not expect to generate losses,

2. The

members practiced in the profession in which the LLC was engaged,

3. The

LLC was not formed for a tax-avoidance purpose

4. The

interests in the LLC were not syndicated, and

5. The equity

partners managed the entity (see Ltr. Ruls. 9321047).

The S corporation on the other hand has no limitation to the type

of accounting method it chooses. An S corporation can not

adopt the cash method if it is a "tax shelter". Of course, where

inventories are used, the accrual method must be adopted unless the IRS permits

otherwise- Reg. 1.4446-1(e)(1).

Debt-Basis Issues

A shareholder of an S corporation can increase his or her

basis by the following ways:

1. By

the amount of funds or basis of property contributed to the capital of the

corporation.

2. By

the amount of funds advanced to the corporation in the form of a loan- Section

1366(d).

An S corporation shareholder can NOT add to stock basis any

indirect contributions, such as the amount of corporate indebtedness,

even if its repayment has been personally guaranteed by the shareholder, unless

the guarantor has made an "actual economic outlay." Basically, did

the shareholder have to put up some money or just a personal guarantee?

Each shareholder of the S corporation is subject to the at-risk

limitation rules under Section 465. This means that loss allocated to a

shareholder may be deducted only to the extent that the shareholder is ‘at

risk’ unless they are exempt from the ‘at risk’ rules. If there is losses in excess of what the shareholder has ‘at risk’

they are suspended and carried forward to the next year to be offset against

income allocated to the shareholder at that time.

Another limitation to shareholder losses is the passive

activity loss rule of Section 469. C corporations are exempt from the

passive activity rules. Each shareholder must determine to what extent they

have participated in activity conducted by the corporation. Everyone would love

to have passive income, because it is not subject to payroll taxes. Here are

the tests to determine if an activity is active:

1. The

individual participates for more than 500 hours during the taxable year.

2. The

participation is the same as all the other participant during the year.

3. The

individual participates for more than 100 hours, but not less than any other

individual.

4. The

activity is a ‘significant participation activity’ and the individual’s

cumulative number of hours or participation exceeds 500 hours.

5. The

individual materially participated in the activity five of the ten years

immediately preceding taxable years

6. The

individual is a service activity and the individual materially participates in

any 3 preceding years.

If you worked at something for less than 100 hours and someone

else works 200 hours your income would be considered passive. This could be

offset by your passive losses.

Members in an LLC are permitted to increase basis in their

interest for their allocable share of entity level debt in accordance with the

Section 752 Regulations. This is not true for S corporations.

Then we have to address the terms ‘recourse’ and ‘nonrecourse’

debt. If an LLC acquires a piece of property and subject to the existing debt

(meaning no member has any liability for it) that would be called ‘nonrecourse’

debt to the LLC. The unique thing about nonrecourse debt is that it can be

allocated to member’s basis disproportionately to their percentage of

ownership. For example, if two people are members of an LLC 50/50. The LLC

purchases a piece of property with debt without the members having to be liable

for the debt. Let’s say the debt is $100,000, instead of distributing it

$50,000 to each partner, you can distribute $20,000 to one partner and $80,000

to another partner!

If an LLC purchased a property and each member personally

guarantees the debt, then it is recourse debt to the LLC and its

members. If in the above example the debt of $100,000 were recourse, then it

would have to be split up 50/50.

The ‘at-risk’ rules also apply to members of an LLC. Usually, most

debt of the LLC is nonrecourse. No member will be able to include it in basis

for ‘at-risk’ purposes. There is an exception, an LLC member who personally

guarantees a debt of the entity will be ‘at-risk’ where his S shareholder

counterpart may not be (remember a personal guarantee does not increase basis

in the shareholder of an S corporation).

Also, if real estate is secured by nonrecourse debt, the LLC

members can qualify for their share of the debt, under the ‘at-risk’ exception

in Section 465 (b)(6)., which is not applicable to S shareholders.

Distributions

For an S corporation without earnings or profits, distributions

are treated first as a nontaxable return of capital to the extent of the

shareholder’s stock basis, and then as a gain from the sale or exchange of

property (Code Sec. 1368(b), Reg. § 1.1368-1(c)).

For a corporation with earnings and profits, unless

an election is made, distributions are treated as follows:

1. a

nontaxable return of capital to the extent of the corporations

"accumulated adjustments account" (AAA);

2. dividends

to the extent of the S corporation’s accumulated earnings and profits

3. a

nontaxable return of capital to the extent of the shareholder’s remaining stock

basis, and

4. gain

from the sale or exchange of property (Code Sec. 1368(C), Reg. § 1.1368-1(d)).

Before applying these rules, the shareholder’s remaining stock

basis and the AAA are adjusted for the corporate items passed through from the

corporate year during which the distributions are made.

The accumulated adjustments account is used to compute the

tax effect of distributions made by an S corporation with accumulated earnings

and profits.

If a C corporation converts to an S corporation, and if the

distribution of corporate property has appreciated while it was in the C

corporation, the built-in gain at the date of conversion will be subject to

corporate-level tax under Section 1374. Distributions of loss property do not

result in the recognition of loss.

For LLCs, the tax treatment of distributions under Subchapter K

will generally be more favorable than the results under Subchapter S,

especially with respect to distributions of appreciated property!

No gain or loss is recognized by the LLC for distributions of

appreciated property. But with an S corporation the distribution will be

taxable!

If property is distributed within a five-year period of being

contributed to the LLC there are some special rules- Section 737. This

applies when a partner contributes appreciated property to a partnership and,

within five years of the contribution, property is distributed back to the

contributing partner. If the value of the distributed property exceeds the distributee’s basis in his partnership interest, and if the

partner continues to hold the property, the distributee

partner will recognize the gain equal to the lessor of:

1. the

excess of the value of the property distributed over the distributee’s

partnership basis or

2. the

net precontribution gain of the distributee-partner

in accordance with Section 704 (c) (1)(B).

Cash distributions in excess of basis are taxable. The other main

point is that any type of distribution in excess of your basis is taxable. The

goal is to have a high basis in your LLC interest. This can be accomplished by

adding debt to the LLC, which was mentioned earlier.

Sales or Exchanges of Equity

Interest

When a shareholder of an S corporation sells part of all of his or

her stock to a third party, the transaction generally will result in capital

gain or loss. Unlike LLCs and partnerships, shareholders of S corporations are

permitted to exchange shares of stock with other shareholders in one or more S

or C corporations pursuant to the requirements of the tax-free reorganization

rules in Section 368.

Where an LLC member sells or exchanges the interest in the LLC,

gain or loss is determined under Section 741 and generally results in capital

gain or loss. If an LLC sells the entire interest, the LLCs year will close on

the date of the sale-Section 706 (C) (2)(A). Also, installment sale reporting

is not available to the extent that the selling member’s share of any

underlying assets of the LLC would be ineligible for installment reporting-

Section 453 (I).

Are You Subject to Self-Employment

Taxes on

Distributions at the End of the Year of an LLC?

The Internal Revenue Code imposes a self-employment tax on a general

partner’s distributive share of income from the partnership’s trade or

business. Code Sec. 1401 and Code Sec. 1402. In contrast, the distributive

share of a limited partner is generally excluded from the

self-employment tax, except to the extent that this share is

a "guaranteed payment" (Code Sec. 1402(a)(13). Pursuant to Code Sec.

707 (c), a "guaranteed payment" is an amount paid to a partner

for services actually rendered to or on behalf of the partnership without

regard to the income of the partnership. It is considered as made to one who is

not a member of the partnership, and is thus subject to the self-employment

tax). Limited partners are exempted from the self-employment tax

rule under the theory that they are more passive investors than true partners

are.

In review, here is the general partner of the LLC (which would be

the manager of the LLC or the member that resembles the characteristics of a

general partner)’s tax situation;

1. A general

partner’s distributions are subject to self-employment taxes,

and

2. Guaranteed

payments are subject to self-employment taxes.

Here are the tax ramifications of a limited partner:

1. Limited

partners are exempt from self-employment taxes, and

2. Guaranteed

payments are subject to self-employment taxes.

The IRS realized that the distinctions for general and limited

partners worked fine for Limited Partnerships, but in the world of LLCs, the

laws didn’t distinguish between the two. Something else had to be done.

The IRS set new proposals for all entities taxed as Limited

Partnerships. They now have a proposed legislation of the definition of a

Limited Partner under Code Sec, 1402(a)(13), which may be made effective before

July 1, 1998. Under the proposed regulation here is the definition of a

limited partner:

A limited partner would be any person classified as a partner

unless they:

1. Had

personal liability for the debts or obligations of the partnership by reason of

being a partner (called the liability test),

2. Had

authority to enter into contracts on behalf of the partnership (called the revised

management test), OR

3. Participated

in the partnership’s trade or business more than 500 hours annually (called the

participation test).

These so-called "functional tests" make it clear that

the distributive share of non-managing members of an LLC will not be

subject to SE (self-employment tax).

Although many do not like this proposed expanded definition of a

limited partner, the final result is right around the corner. The reason the

expanded definition is largely unwelcome due to the concern it will cause for

more record keeping as well as imposing new taxes on partners.

Nevada Commercial Registered Agent

Entity

# E0502742015-6

NV

Business ID NV20151637034

|

Nevada Registered Agent Service™ |

Services |

Important

Information |

Company |

|

|

|

|

|

|

10409 Pacific Palisades Ave. |

|||

|

Las Vegas, NV 89144-1221 |

|||

|

|

|||

|

(702) 628-7279 - Phone |

|||

|

(800) 948-0601 - Fax |

|||

|

|

|

|

© 2025 Marc Gohres

Revised June 16,

2025 10:52 AM

THIS IS A SECURE SSL WEBSITE PROTECTED BY SHA-2 AND 2048-BIT END

TO END ENCRYPTION

Nevada Registered Agent Service™ and the

Nevada Registered Agent Service™ logo are

registered trademarks and may not be used, displayed or reproduced without

written consent of Nevada

Registered Agent Service™.

Your use of this website and its contents

constitutes acceptance and agreement of our TERMS OF USE and our PRIVACY POLICY.